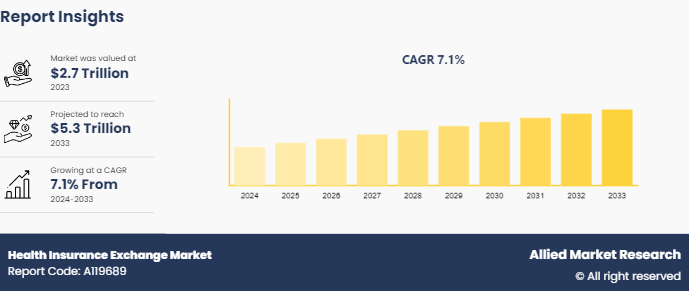

Health Insurance Exchange Market to Skyrocket to $5.3 Trillion Globally by 2033, Growing at a 7.1% CAGR,

Health Insurance Exchange Market Size

WILMINGTON, NEW CASTLE, DE, UNITED STATES, December 27, 2024 /EINPresswire.com/ -- Allied Market Research published a report, titled, "Health Insurance Exchange Market by Type of Insurance (Individual Health Insurance, Family Health Insurance, and Group Health Insurance), Distribution Channel (Online and Offline), and End User (Children, Adults and Senior Citizens): Global Opportunity Analysis and Industry Forecast, 2024-2033". According to the report, the health insurance exchange market was valued at $2.7 trillion in 2023 and is estimated to reach $5.3 trillion by 2033, growing at a CAGR of 7.1% from 2024 to 2033.

✅ 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 - https://www.alliedmarketresearch.com/request-sample/A119689

𝐏𝐫𝐢𝐦𝐞 𝐃𝐞𝐭𝐞𝐫𝐦𝐢𝐧𝐚𝐧𝐭𝐬 𝐨𝐟 𝐆𝐫𝐨𝐰𝐭𝐡

Health insurance exchanges, including both public and private, are driven by the need for accessible, affordable, and customizable healthcare coverage. Public exchanges offer convenience and government subsidies, making them attractive for individuals seeking financial assistance. On the other hand, private exchanges provide a broader range of plan options, tailored support, and cost-control benefits, particularly appealing to employers looking for flexibility and personalized solutions. While group health insurance offers certain advantages, it also comes with limitations that may prompt employers to seek alternative solutions. One significant drawback of group plans is their lack of flexibility, which restricts employees' ability to choose their preferred network, deductible, or premium. The emergence of blockchain technology presents significant opportunities for health insurance exchanges to enhance their processes and improve outcomes for both insurers and policyholders. By leveraging blockchain, exchanges can streamline administrative tasks, ensure the security of sensitive data, and effectively prevent instances of insurance fraud. Moreover, blockchain technology facilitates seamless data sharing and enhances the efficiency of claim filing and approval processes.

𝐑𝐞𝐜𝐞𝐧𝐭 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬

➤ 𝐈𝐧 𝐌𝐚𝐲 𝟐𝟎𝟐𝟒, Affordable Care Act (ACA) Marketplace enrollment soared to over 21 million, nearly double the figure from 2020 in the U.S. This record growth is largely attributed to enhanced subsidies provided under the American Rescue Plan Act, which significantly reduce premiums for enrollees.

➤ 𝐈𝐧 𝐌𝐚𝐲 𝟐𝟎𝟐𝟒, the Biden administration's new rule expanded the healthcare access for Deferred Action for Childhood Arrivals (DACA) recipients, allowing them to participate in Obamacare exchanges. Previously unable to access these exchanges, DACA recipients like Josue Rodriguez welcomed the change, recognizing the financial burden of private insurance. With approximately 600, 000 DACA recipients in the U.S., this move could provide coverage for about 100, 000 currently uninsured individuals.

𝐁𝐚𝐬𝐞𝐝 𝐨𝐧 𝐭𝐲𝐩𝐞 𝐨𝐟 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞, 𝐭𝐡𝐞 𝐟𝐚𝐦𝐢𝐥𝐲 𝐡𝐞𝐚𝐥𝐭𝐡 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐬𝐮𝐛-𝐬𝐞𝐠𝐦𝐞𝐧𝐭 𝐢𝐬 𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐠𝐫𝐨𝐰 𝐟𝐚𝐬𝐭𝐞𝐫 𝐝𝐮𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝.

Family health insurance exchange offers inclusive coverage for the entire family, including spouse, children, and parents. In addition, the flexibility to add new members seamlessly during the policy term enhances its attractiveness. Lower premiums compared to individual plans make family health insurance a cost-effective choice, encouraging more families to opt for coverage. Furthermore, the high coverage limits and the option for cashless claims alleviate the financial burden during medical emergencies, resulting in increased participation.

✅ 𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.alliedmarketresearch.com/health-insurance-exchange-market/purchase-options

𝐁𝐚𝐬𝐞𝐝 𝐨𝐧 𝐝𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐜𝐡𝐚𝐧𝐧𝐞𝐥, 𝐭𝐡𝐞 𝐨𝐧𝐥𝐢𝐧𝐞 𝐬𝐮𝐛-𝐬𝐞𝐠𝐦𝐞𝐧𝐭 𝐢𝐬 𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐠𝐫𝐨𝐰 𝐟𝐚𝐬𝐭𝐞𝐫 𝐝𝐮𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝.

Online health insurance exchange platforms offer numerous advantages as they provide easy comparison tools, allowing users to assess multiple plans simultaneously and make informed decisions. This streamlined approach saves time and effort, offering a comprehensive view of plan features and pricing. Cost-effectiveness is another key driver, with online insurance exchange platforms minimizing overhead expenses associated with traditional offline methods. This leads to reduced premiums and transparent pricing structures, empowering users to understand and control their expenses better.

𝐁𝐚𝐬𝐞𝐝 𝐨𝐧 𝐞𝐧𝐝 𝐮𝐬𝐞𝐫, 𝐭𝐡𝐞 𝐚𝐝𝐮𝐥𝐭𝐬 𝐬𝐮𝐛-𝐬𝐞𝐠𝐦𝐞𝐧𝐭 𝐢𝐬 𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐠𝐫𝐨𝐰 𝐟𝐚𝐬𝐭𝐞𝐫 𝐝𝐮𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝.

Health insurance exchanges are widely purchased by adults as they often have complex healthcare needs that require comprehensive coverage, making health insurance essential for accessing quality care. In addition, as adults age, they become more susceptible to health issues and chronic conditions, increasing the necessity for reliable insurance coverage. Health insurance exchanges offer flexibility, allowing adults to choose plans tailored to their specific needs and budgets. Moreover, the convenience of online platforms and the ability to compare multiple options make health insurance exchanges particularly appealing to busy adults seeking efficient solutions for their healthcare needs.

𝐁𝐚𝐬𝐞𝐝 𝐨𝐧 𝐫𝐞𝐠𝐢𝐨𝐧, 𝐀𝐬𝐢𝐚-𝐏𝐚𝐜𝐢𝐟𝐢𝐜 𝐢𝐬 𝐩𝐫𝐞𝐝𝐢𝐜𝐭𝐞𝐝 𝐭𝐨 𝐬𝐡𝐨𝐰 𝐭𝐡𝐞 𝐟𝐚𝐬𝐭𝐞𝐬𝐭 𝐠𝐫𝐨𝐰𝐭𝐡 𝐝𝐮𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝.

Health insurance exchanges have gained popularity in Asia-Pacific countries due to increasing demand for comprehensive health coverage amid rising healthcare costs and evolving consumer needs. Well-known exchanges in the region include Singapore's MediShield Life and Malaysia's MySalam, which offer accessible platforms for individuals to compare and purchase insurance plans tailored to their requirements. These exchanges provide a transparent marketplace where consumers can evaluate various options, ensuring better decision-making and enhanced affordability. In addition, exchanges like Thailand's National Health Security Office (NHSO) and Australia's Private Health Insurance Rebate scheme promote universal coverage and financial assistance, which is driving the regional market growth.

✅ 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐭𝐨 𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐭𝐡𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 - https://www.alliedmarketresearch.com/purchase-enquiry/A119689

𝐌𝐚𝐣𝐨𝐫 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬

Allianz

AXA

Ping An Insurance

China Life Insurance Company

AIA Group

Ping An Insurance Group

Aviva

Prudential Financial

Zurich Insurance Group

MetLife

The report provides a detailed analysis of these key players in the global health insurance exchange market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions.

𝐀𝐛𝐨𝐮𝐭 𝐮𝐬 :

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

Distribution channels: IT Industry, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release